We had a small pullback this week, which was well-needed in my opinion. On the daily chart of the SPY we're forming a triangle consolidation withing a larger pattern. I expect the market to find support around the lows of friday, or perhaps a tad lower near the 141 area, which coincides with the 20d MA. Volume is likely going to be lower until the new year, which is often good for small caps or stocks with high short ratios.

Here are some stocks I'm watching for the week:

Long: CTXS, SMBL, GPRE, EXPR, DNDN, RVBD, BAC, SLXP, CLMT, FXEN, CPHD, AMD

In play: SWHC, ARIA

Bounce: DKS, ARIA, AVD, TEVA, OPTR, ALLT, SWKS

Short: BEN, CALL, FB, USB, CHK, CALI, NAK

Parabolic short: NED, QUAD, NEON, RKUS, ICPT, TSL, STXS

Good luck this week!

Sunday, December 16, 2012

Sunday, December 9, 2012

Watchlist for the week of Dec 10-15

Last week we printed a bunch of dojis in a row, marking some indecision in the market. On the SPY daily chart, we're consolidating in a flag, or ascending triangle. All the moving averages, except for the 50d MA are curving up, and it seems like we might try to make a run to the highs by the end of the year. Typically December is a good month for equities, especially small caps which usually run wild into the end of the year! The only thing that concerns me is that we are slightly overbought, particularly on the Russell and the QQQs are weak in comparison to the other indices. I'm positioned slightly long, but I would get concerned if we broke below the 50d again though and even more if we breakdown from this triangle consolidation...

Here are some stocks I'm watching for the week:

Long: MNST, SMBL, GPRE, CNC, KLAC, LULU, HUN, FST, SIG, IDIX, MCP, Z, COV, BTH, AMD, CYBX

Red/green: HUM, MHP

In play: GMCR, SWHC, GRPN, FB

Bounce: FCX, LFVN

Short: HES, TOL, LEN, JOBS, NOV, OSTK, ZLC, CALL, SINA, PCYC

Parabolic short: CBMX, MHP, SD, GTIM, UNXL, GNW, BEAM, MU, RKUS

Send me a tweet if you want more info on how I play these setups @cath_campbell

Good luck this week!

Here are some stocks I'm watching for the week:

Long: MNST, SMBL, GPRE, CNC, KLAC, LULU, HUN, FST, SIG, IDIX, MCP, Z, COV, BTH, AMD, CYBX

Red/green: HUM, MHP

In play: GMCR, SWHC, GRPN, FB

Bounce: FCX, LFVN

Short: HES, TOL, LEN, JOBS, NOV, OSTK, ZLC, CALL, SINA, PCYC

Parabolic short: CBMX, MHP, SD, GTIM, UNXL, GNW, BEAM, MU, RKUS

Send me a tweet if you want more info on how I play these setups @cath_campbell

Good luck this week!

Saturday, December 1, 2012

Watchlist for the week of Dec 3-7

Last week was pretty interesting with that huge reversal on wednesday and a strong close. Since then we've had 2 doji days and it seems like the market is just coiling before going higher. I would expect a few days of consolidation, but if we can get above that ~142.50 clear level of resistance, we could run back up to the highs of the year. And december is typically a good month, with lots of small caps making big runs.

Here's a list of stocks I'll be watching this week. I've added a few thin, small cap names since they can typically run during the month of december. If you want, you can copy an entire line of symbols here and paste them in Finviz, which allows you to see all the charts at once, like this.

Long: SMBL, GPRE, CNC, JOBS, MNST, FSLR, LNKD, SNTA, ADNC, VVUS, TEX, AUMN, MBI, ESI, PGH, AVID, OSUR

Short: GNRC, PCYC, HIBB, BKS

Parabolic short: SGYP, PPHM, CARV, EXPR, ANAD, JRCC (not officially a parabolic, but similar idea)

Below I marked up a couple of charts for examples of how to play these setups:

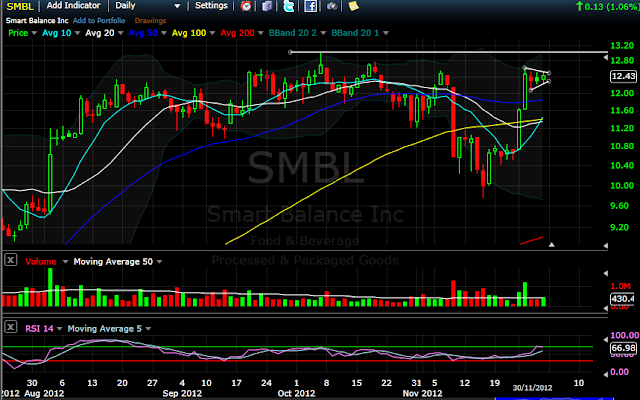

SMBL: Nice flag on the daily, and near long-term resistance. Long above 12.50 or so, with first target at around 13, and a stop below 12.09

VVUS: Nice triangle consolidation, seems to have put in a bottom. Long above 11.60 or so, target to ~14.00 and stop just below 11.

GNRC: It's hovering on the edge of that gap area. Short below 32.4, first target around 30, then perhaps 28.70, with a stop above friday's hod ~33.

Here's a list of stocks I'll be watching this week. I've added a few thin, small cap names since they can typically run during the month of december. If you want, you can copy an entire line of symbols here and paste them in Finviz, which allows you to see all the charts at once, like this.

Long: SMBL, GPRE, CNC, JOBS, MNST, FSLR, LNKD, SNTA, ADNC, VVUS, TEX, AUMN, MBI, ESI, PGH, AVID, OSUR

Short: GNRC, PCYC, HIBB, BKS

Parabolic short: SGYP, PPHM, CARV, EXPR, ANAD, JRCC (not officially a parabolic, but similar idea)

Below I marked up a couple of charts for examples of how to play these setups:

SMBL: Nice flag on the daily, and near long-term resistance. Long above 12.50 or so, with first target at around 13, and a stop below 12.09

VVUS: Nice triangle consolidation, seems to have put in a bottom. Long above 11.60 or so, target to ~14.00 and stop just below 11.

GNRC: It's hovering on the edge of that gap area. Short below 32.4, first target around 30, then perhaps 28.70, with a stop above friday's hod ~33.

Saturday, November 17, 2012

Watchlist for the week of Nov 19-23, 2012

So last week the market fell pretty hard and we dropped to the 61.8% Fib. This was a little more than I anticipated, but we did form a slight divergence on the RSI which I was watching. Is this the bottom? I don't know, but it sure feels like it might be. The strong buying during the second half of friday tells me we're in for at least a decent bounce.

I shorted some 3x ETFs on thursday and friday (the SOXS, TZA, SQQQ), and I plan to hold onto these for a while in my swing portfolio. Typically december and january are good months for the market, so I'm hoping this trend continues.

It's going to be a short week because of thanksgiving, but I suspect we'll bounce to ~138 in the SPY, which around the 50% Fib level, as well as the 200d MA. After that, we'll have to re-evaluate and see where the market might be headed.

There were a lot of hammers that were put in on friday, so I picked some of these charts and will be looking for continuation. The best hammers are those that happen on high volume, in combination with price support and even better if they bounce off a moving average.

Long (flags or consolidations): SRPT, HGT, FMCN, NFLX, LEAP, GGC, GPRE, TEAR, WCRX, CNC, TRMB, GEOY, AVG, TSLA, FRO, ARMH

Long (hammers): FSLR, CNX, ATRS, CRUS, STEI, JCOM, HRS, SIG, ULTI, DDD

Oversold bounce: WIN, ATR, JCP, MCP, ESI, CPE, MBI, ERF, SKUL, BTH, PBI

Shorts: ROSG, JAH, MIC

Parabolic shorts: NVGN, MEIP, STV, CYBX, SGYP (not parabolic, but coming into MA resistance)

Good luck this week!

I shorted some 3x ETFs on thursday and friday (the SOXS, TZA, SQQQ), and I plan to hold onto these for a while in my swing portfolio. Typically december and january are good months for the market, so I'm hoping this trend continues.

It's going to be a short week because of thanksgiving, but I suspect we'll bounce to ~138 in the SPY, which around the 50% Fib level, as well as the 200d MA. After that, we'll have to re-evaluate and see where the market might be headed.

There were a lot of hammers that were put in on friday, so I picked some of these charts and will be looking for continuation. The best hammers are those that happen on high volume, in combination with price support and even better if they bounce off a moving average.

Long (flags or consolidations): SRPT, HGT, FMCN, NFLX, LEAP, GGC, GPRE, TEAR, WCRX, CNC, TRMB, GEOY, AVG, TSLA, FRO, ARMH

Long (hammers): FSLR, CNX, ATRS, CRUS, STEI, JCOM, HRS, SIG, ULTI, DDD

Oversold bounce: WIN, ATR, JCP, MCP, ESI, CPE, MBI, ERF, SKUL, BTH, PBI

Shorts: ROSG, JAH, MIC

Parabolic shorts: NVGN, MEIP, STV, CYBX, SGYP (not parabolic, but coming into MA resistance)

Good luck this week!

Sunday, November 11, 2012

Watchlist for the week of Nov 13-16

The market made it down to my target and I grabbed some 3x long ETFs on friday for a bounce trade. I deceided to take my profits by friday afternoon as I just wasn't feeling confident the market would bounce for more than a day... I'll be looking to get back long in the next few days or couple of weeks, but I'll be waiting for the scenario outlined below. Ideally, we get a lower low with some type divergence on the indicators, RSI, MACD or stochastics, as you can see in the chart below. A double bottom would work just as well, as long as there is also a divergence formed... That would be my ideal scenario, but we'll have to see what the market has in mind.

Sunday, November 4, 2012

Watchlist for the week of Nov 5-9

Well, the market briefly bounced last week, but on fridayit got rejected at the 50d MA and we ended the day with a big bearish engulfing candle. This bodes well for more downside, and I'm still looking for the target of ~138 on the SPY and my chart from last week basically hasn't changed much. I will likely be playing more short setups this week, but we'll have to see what happens. The presidential elections will likely have an impact on the market, so it will likely be an interesting week. See the chart below:

Here are a few setups I'll be watching this week:

Long: SVU, TASR, OSTK, MTB, MTG, CTRP, SRPT, LPHI, SANM

Red/green: SLCA, ANTH, AZC, XIDE, STP

Bounce: NUVA, CRUS, ZUMZ, VVUS, ALXN

Short: XNPT, REGN, OCN, ZLC, ALNY, SMBL, SMCI, DVAX, BVSN

Parabolic short: ENZ, ALC, BGFV, CARB, ACCO, VAR, IMH, PBH, HNSN

Drop me a line if you want more information on how to play these setups and good luck this week!

Here are a few setups I'll be watching this week:

Long: SVU, TASR, OSTK, MTB, MTG, CTRP, SRPT, LPHI, SANM

Red/green: SLCA, ANTH, AZC, XIDE, STP

Bounce: NUVA, CRUS, ZUMZ, VVUS, ALXN

Short: XNPT, REGN, OCN, ZLC, ALNY, SMBL, SMCI, DVAX, BVSN

Parabolic short: ENZ, ALC, BGFV, CARB, ACCO, VAR, IMH, PBH, HNSN

Drop me a line if you want more information on how to play these setups and good luck this week!

Monday, October 29, 2012

Watchlist for the week of Oct 30 to Nov 2

Last week we had some more distribution on good volume and I'm looking for a little more downside before trying some long swings. I posted this chart last wednesday when I noticed the similarities with the correction from May 2012.

I would love to see the SPY retrace back to the 200d MA, which also coincides with the 50% Fib retracement of the entire move from the June lows. This ~138 level was also an important resistance level in the beginning of the year and in the summer, and also happens to be around the highs from 2011. Finding some support there would make sense to me, but we'll have to see what happens. Notice the bear flag on the daily, similar to the one from May 2012, and the heavy distribution volume.

The only thing that concerns me is that the Russell and the Nasdaq have already retraced 50% of their move from the June lows, and they are somewhat oversold on the dailies. I expect some type of bounce this week, especially after the nice close we had on friday, but overall I'll be looking for more lows in the next couple of weeks.

Here's some stocks I'll be watching this week:

Long: AUQ, MTG, MTB, HGT, TSN, LNG, URI, CTRP

Oversold or dead cat bounce: AVID, VRSN, RGS, NFX, HMSY, MPO, RGS

Red to green: OCN, WAC, ETR

Short: ALXN, ISIS, ARNA, GFI, PPHM, PBT, ROSG,

Parabolic shorts: OFG, OSTK, TASR, PKI, WBMD, AEGR, CYCC, NFLX (might get parabolic, not there yet)

Drop me a line if you want more info on how to play these setups... and good luck this week!

I would love to see the SPY retrace back to the 200d MA, which also coincides with the 50% Fib retracement of the entire move from the June lows. This ~138 level was also an important resistance level in the beginning of the year and in the summer, and also happens to be around the highs from 2011. Finding some support there would make sense to me, but we'll have to see what happens. Notice the bear flag on the daily, similar to the one from May 2012, and the heavy distribution volume.

The only thing that concerns me is that the Russell and the Nasdaq have already retraced 50% of their move from the June lows, and they are somewhat oversold on the dailies. I expect some type of bounce this week, especially after the nice close we had on friday, but overall I'll be looking for more lows in the next couple of weeks.

Here's some stocks I'll be watching this week:

Long: AUQ, MTG, MTB, HGT, TSN, LNG, URI, CTRP

Oversold or dead cat bounce: AVID, VRSN, RGS, NFX, HMSY, MPO, RGS

Red to green: OCN, WAC, ETR

Short: ALXN, ISIS, ARNA, GFI, PPHM, PBT, ROSG,

Parabolic shorts: OFG, OSTK, TASR, PKI, WBMD, AEGR, CYCC, NFLX (might get parabolic, not there yet)

Drop me a line if you want more info on how to play these setups... and good luck this week!

Sunday, October 21, 2012

Watchlist for Oct 21-25

We had a pretty heavy distribution day on friday and the Russell and Nasdaq broke some important levels of support. The SPY and DIA are right on support, but it doesn't look like this support will hold this week. The SPY had been in a range for almost 2 months, but now it seem like we will breakout of the box lower. I suspect we might have a day or two of bounce in the cards perhaps this week, but friday was a big sign that we're not done going lower in my opinion. There is growing evidence that we may have put in an intermediate term top:

- high volume distribution

- attempting to make new highs, but not being able to (SPY for example)

- breaking significant levels of support

- other factors, including the weakness is former market leaders (GOOG, AAPL, etc)

Another important factor to note is the MACD and RSI divergences on the weekly charts, here's an example with SPY:

The only three sectors that seem to be holding to be holding up ok are the financials and the silver and gold miners (SIL, GDX).

To be honest, I didn't find many great setups, so I'll probably be more cautious this week... in any case, here are a few stocks to watch this week:

Long: BAC, JAG, AEM, AUY, AUQ, BBG, HGT, INSM, TSN, CNC, MDRX

Short: CRR, GFI, MPO, TSO, FITB, PB, GDOT, ACW, ROSG, ALNY, JAZZ, GILD, PPHM

Parabolic shorts: OEH, GIVN, GURE, HLSS, DF, MEET

- high volume distribution

- attempting to make new highs, but not being able to (SPY for example)

- breaking significant levels of support

- other factors, including the weakness is former market leaders (GOOG, AAPL, etc)

Another important factor to note is the MACD and RSI divergences on the weekly charts, here's an example with SPY:

The only three sectors that seem to be holding to be holding up ok are the financials and the silver and gold miners (SIL, GDX).

To be honest, I didn't find many great setups, so I'll probably be more cautious this week... in any case, here are a few stocks to watch this week:

Long: BAC, JAG, AEM, AUY, AUQ, BBG, HGT, INSM, TSN, CNC, MDRX

Short: CRR, GFI, MPO, TSO, FITB, PB, GDOT, ACW, ROSG, ALNY, JAZZ, GILD, PPHM

Parabolic shorts: OEH, GIVN, GURE, HLSS, DF, MEET

Sunday, October 7, 2012

Watchlist for the week of Oct 8-12

We had a nice bounce this week and the SPY held converging levels of support at ~143. The DJ is at 52w highs, but the russell and the nasdaq are lagging... Overall the picture is neutral (with a slightly more bullish tone) and I could see us consolidating in this box for a couple of weeks. I think a breakout is likely, but it might take a little more time.

Here are some stocks I'll be watching this week:

Long: AFFX, PATK, BODY, SNTA, CECO, OMX, SVN, ES, AXTI, ALSK, CLSN

Short: FSLR, VVUS, PPHM, IDIX, NAV, CNC, GMCR, DNDN, RSH, XPO

Parabolic shorts: IMH, SFUN, INSM, OCN, SVA, FONR

Bounce: CMG, PBM, NUVA, XRTX, MSCI

Red/Green: DCTH

In Play: SRPT, NFLX, PAY, QCOR, PPP, SNSS

If you don't know how to play these setups, drop me a line and I can explain what I look for!

good luck!

Here are some stocks I'll be watching this week:

Long: AFFX, PATK, BODY, SNTA, CECO, OMX, SVN, ES, AXTI, ALSK, CLSN

Short: FSLR, VVUS, PPHM, IDIX, NAV, CNC, GMCR, DNDN, RSH, XPO

Parabolic shorts: IMH, SFUN, INSM, OCN, SVA, FONR

Bounce: CMG, PBM, NUVA, XRTX, MSCI

Red/Green: DCTH

In Play: SRPT, NFLX, PAY, QCOR, PPP, SNSS

If you don't know how to play these setups, drop me a line and I can explain what I look for!

good luck!

Sunday, September 23, 2012

Watchlist for Sept 24

The market digested last week, and I feel like the consolidation was quite bullish. As long as we hold the ~144 level on the SPY, I'm still leaning long.. In fact, dips to the 20d MA would be good opportunities to get long. And the environment these days is more condusive to holding stocks for swings, ie a few days at least. Breakouts are working, and I've been seeing more follow-through, so that's a good bullish sign!

Here's a few stocks I'm watching tomorrow and perhaps this week:

Long: SINA, MCP, SSH, OTT, SVU, ZNGA, ARNA, ODP, GENE, ROSG, STEI, UBNT, EDU, EGLE, SYNC, RSH, MTG

Shorts and parabolic shorts: MACK, PPHM, CDE, GSS, AMPE, IEC, HALO, STI, OMX, IMH, MNST

Bounce: DDD, IHS, XPO, HEES

I'm already long a little ZNGA, SVU, JAG and RSH for swings.

Here's a few stocks I'm watching tomorrow and perhaps this week:

Long: SINA, MCP, SSH, OTT, SVU, ZNGA, ARNA, ODP, GENE, ROSG, STEI, UBNT, EDU, EGLE, SYNC, RSH, MTG

Shorts and parabolic shorts: MACK, PPHM, CDE, GSS, AMPE, IEC, HALO, STI, OMX, IMH, MNST

Bounce: DDD, IHS, XPO, HEES

I'm already long a little ZNGA, SVU, JAG and RSH for swings.

Sunday, September 16, 2012

Game plan for the week of Sept 17-21

Last week was really bullish, and the announcement of more QE from the FED means we're likely going to continue this bull market for several more months. However, we are slightly extended here on the major indices, being above the upper BB, so I would be expecting a small pullback or at least sideways consolidation. But any pullbacks should be viewed as opportunities to get long in my opinion.

Here's a daily chart of the SPY:

And here's some stocks I'll be watching this week:

Long: TSYS, APKT, PZZI, GMCR, YELP, TTMI, CHK, PACW, MVIS, HDY

Short: CNC, REED, VIRC, CUR, FBN, BIOF, OMX, HNI

Here's a daily chart of the SPY:

And here's some stocks I'll be watching this week:

Long: TSYS, APKT, PZZI, GMCR, YELP, TTMI, CHK, PACW, MVIS, HDY

Short: CNC, REED, VIRC, CUR, FBN, BIOF, OMX, HNI

Monday, September 3, 2012

Watchlist for the week of Sept 4-7, 2012

I've had family visiting for all of August, so been away from trading for about a month now, ut now I'm back and ready to trade again!

During the first half of August, the market trended higher, but the SPY was firmly rejected at the 143 level. And now we have been consolidating near the top of the recent highs for about two weeks. We're still in the ascending channel that you can see in my SPY chart below, and this has been my guide all summer. We've moved away from the top of the channel, and we seem to be setting up to break higher. A move above 142 would be very bullish in my opinion. Keep an eye on that mini-triangle forming on the daily chart below. The bollinger bands are tightening, so I think a big move is coming soon.

During the first half of August, the market trended higher, but the SPY was firmly rejected at the 143 level. And now we have been consolidating near the top of the recent highs for about two weeks. We're still in the ascending channel that you can see in my SPY chart below, and this has been my guide all summer. We've moved away from the top of the channel, and we seem to be setting up to break higher. A move above 142 would be very bullish in my opinion. Keep an eye on that mini-triangle forming on the daily chart below. The bollinger bands are tightening, so I think a big move is coming soon.

There are tons of bullish looking setups out there, so many in fact, that I couldn't condense my list as short as I wanted! Here are a few ideas for the week ahead:

Long: SINA, LNG, CYOU, YNDX, LSI, MPEL, LVS, LNKD, CREE, AZC, NAK, APKT, MEOH, DECK, LULU, TIF, ES, TTWO, AIR, MPG, DSCO

Parabolic shorts: NTE, RPRX, SRPT, STEM, GERN, IMH, ZLC

Shorts: VVUS

Monday, July 23, 2012

What next?

We got to my target ~135 in the SPY much faster than I had anticipated, so what now? Well, I think we're headed lower... we might consolidate for 1-2 days, but the next target that I'm looking for is ~132, where the 200d will be in a few days!

Sunday, July 22, 2012

Watchlist for the week of July 22nd, 2012

So last week we got to my 138 target on the SPY and near the top of the bear flag on the daily chart. I went short near that target, but I was too scared to hold over the week-end. The SPY and the DIA printed a doji on thursday, right near resistance, so that was a fairly good "caution" signal. The next day we gapped down, so it seems we might have a short-term change in trend. I'm expecting more decline in the indices this week, but we might need to consolidate a little more before a fall back down to the ~135 area in the SPY, as there are many moving averages below the current price that will serve as support (the 10, 20, 50 and 100d MAs). Eventually, I think we might break down from this bear flag on the daily, but I'll have to see confirmation of that before going all in short! Below is a daily chart of the SPY, with my target near 135 highlighted:

Here are some stocks I'm watching for the week:

Long: ENTR, AFFY, GERN (above the 200d only), CLDX, AUTH, ALNY, BWS, COG, KEG, MSM, DDD

Short: AUXL, PCYC, SOHU, GNW, MHR, MCP, SBUX, HTZ, FONR, ORI

Parabolic short: PSTI (I'm already short this name), STEM (also have 1/4 left short), KEQU, PPHM, CPRX, ALJ

Dead cat bounces: DF, WHX (maybe one more day), CMG, OSG, HHS, IRG, GORO, STAA

Good luck this week, and feel free to drop me a line if you have any comments or questions!

Here are some stocks I'm watching for the week:

Long: ENTR, AFFY, GERN (above the 200d only), CLDX, AUTH, ALNY, BWS, COG, KEG, MSM, DDD

Short: AUXL, PCYC, SOHU, GNW, MHR, MCP, SBUX, HTZ, FONR, ORI

Parabolic short: PSTI (I'm already short this name), STEM (also have 1/4 left short), KEQU, PPHM, CPRX, ALJ

Dead cat bounces: DF, WHX (maybe one more day), CMG, OSG, HHS, IRG, GORO, STAA

Good luck this week, and feel free to drop me a line if you have any comments or questions!

Sunday, July 15, 2012

Watchlist for the week of July 16th, 2012

We had a nice bounce in the markets on friday, and I'm expecting a little continuation next week. I suspect we'll see the ~138 level in the SPY, with maybe a little consolidation ~ 136.5 along the way. However, we're forming a bear flag as you can see in the daily chart below, which leads me to believe that we might be headed lower in the intermediate term. I've added a horizontal trendline that is sort of my "bull/bear" line in the sand... I'm also watching the edges of the flag for low risk opportunities and to improve my timing in buying/shorting individual names.

Ideally, I would like to see a lower low in the indices, accompanied by some strong divergence signals, like we saw last summer (the chart below is an example with the MACD divergence, although stochastics, RSI and other indicators also showed some divergences). This is typically what a bottom looks like...

It's also interesting to note the negative divergence that formed two weeks ago in the SPY (shown below), and this also happened back inte Sept-2011, so keep an eye on your indicators to get a sense of the overall possible direction.

Here are some ideas for the week:

Parabolic shorts: AFFY, CADX, ETRM, NVAX

Shorts: RPRX (see the chart below), PCYC, PCRX, SMBL, CYTR, DDS, GNK, FONR

Longs: PRMW, LNG, CIE, DMND, PATK, RSE, PSX, ECYT, ASGN, LPI, DXCM

Dead cat bounce: NLST, ADTN, QTM, CALX, SVU, PAL, LXK, AMPE, MAKO, DGIT (sitting on support, see chart below)

It takes me too long to post charts for the whole watchlist, but if you're not sure how to trade these, drop me a line at cathcampbell_25 (at) hotmail dot com and I can explain what I'm seeing and how to trade particular setups.

Good luck this week!

It's also interesting to note the negative divergence that formed two weeks ago in the SPY (shown below), and this also happened back inte Sept-2011, so keep an eye on your indicators to get a sense of the overall possible direction.

Here are some ideas for the week:

Parabolic shorts: AFFY, CADX, ETRM, NVAX

Shorts: RPRX (see the chart below), PCYC, PCRX, SMBL, CYTR, DDS, GNK, FONR

Longs: PRMW, LNG, CIE, DMND, PATK, RSE, PSX, ECYT, ASGN, LPI, DXCM

Dead cat bounce: NLST, ADTN, QTM, CALX, SVU, PAL, LXK, AMPE, MAKO, DGIT (sitting on support, see chart below)

It takes me too long to post charts for the whole watchlist, but if you're not sure how to trade these, drop me a line at cathcampbell_25 (at) hotmail dot com and I can explain what I'm seeing and how to trade particular setups.

Good luck this week!

Sunday, June 10, 2012

Week of June 10, 2012

Futures are way up tonight, so we should gap up tomorrow. The key level is 134 on the SPY and we'll probably gap above that. I'm not going to chase such a big gap up, but I wish I was more long in my acocunt! In any case, I'll be looking for dips to buy and particular stocks that breakout on volume. Breakouts should have lots of follow-through on monday!

I'm not posting any charts, but here's some sstuff I'm watching: Long: HUSA, ZNGA, RCON, GTIM, ROYL, GNE, NCIT, ONTY, ARNA, SGI, RST, END

Short: PCYC, ZLCS, CALL, BHI, FOLD

I like the small caps on big up days because they can run 10-15% if there is decent follow-through!

Good luck!

I'm not posting any charts, but here's some sstuff I'm watching: Long: HUSA, ZNGA, RCON, GTIM, ROYL, GNE, NCIT, ONTY, ARNA, SGI, RST, END

Short: PCYC, ZLCS, CALL, BHI, FOLD

I like the small caps on big up days because they can run 10-15% if there is decent follow-through!

Good luck!

Thursday, June 7, 2012

Update June 7th, 2012

The market has bounced nicely off the ~127 level on the SPY. We had two big up days on tuesday and wednesday this week, and then an almost 1% gap up today. I took most of my profits on my longs right at the open and in pre-market this morning, but I should have just taken them all off! Anyway, I'm looking for some consolidation/digestion in the next couple of days, and maybe the formation of an inverse head and shoulder on the indices. See possible scenario on the chart below:

I don't see much in terms of actionable setups, but here's a few stocks that I'm watching: RST, END, SGI, PVA, FB, VHC, ARNA, BVSN, HGT.

I don't see much in terms of actionable setups, but here's a few stocks that I'm watching: RST, END, SGI, PVA, FB, VHC, ARNA, BVSN, HGT.

Sunday, May 13, 2012

Watchlist for the week of May 14-18, 2012

The market has been pretty weak of late, and even the oversold bounces have not been very convicing. All the indices appear to be forming bear flags on the daily charts and we are likely headed lower. The bear flags might be too obvious, and often when everyone is watching the same pattern, these patterns don't work out... so be ready for anything!

We are getting close to some interesting areas of support, but I will try not to jump in on the long side too early this time. On the SPY, I'll be watching these areas of support: ~133, 130 and 128.

We are getting close to some interesting areas of support, but I will try not to jump in on the long side too early this time. On the SPY, I'll be watching these areas of support: ~133, 130 and 128.

Here's some stocks that I'm watching this week:

Long: HW, AWAY, MRH, POWI, BLDR, HDSN, APOG

Short: SUNH, IMOS, THLD, ALSK, ANSS

Parabolic short: ARNA, RPRX, RST, AXK, HTH

Dead cat bounce: CHK, NANO, FOSL, SFY, MAKO, HLF, DECK, BODY, TAST, RNDY, CPNO, RNF

For a quick view of charts, you can copy the tickers and paste them into Finviz, check it out:

Tuesday, May 8, 2012

Update on the box

So we've broken down from the box I drew a few weeks ago that I posted on chart.ly (http://chart.ly/6grx88i).

My initial target is ~133.50 to 134 on the SPY, and if that doesn't hold, we could see a deeper correction. I started legging into some longs today in small size, in anticipation that 134 will hold, but if it doesn't, I'll probably be stopped out on my positions.

Another thing I'm keeping an eye on is oil, which just had 5 nasty days. I started a small 1/5 size long position today in USO and will average in. USO is pretty oversold on the daily, and I think this level of 36 is a pretty decent spot to buy. I will add more if we get to ~35.

Sunday, March 25, 2012

Watchlist for the week of March 26-30

The indices are still all in a uptrend. There is no reason to be short, at least not yet... Watch that ascending trendline for a break or for a trend change.

Here are a few stocks that I'm watching for the week:

Long: SIMG, AMED, TA, AVID, ZUMZ, PAY, MX, VVTV, VVUS, GIL, CYOU, SFLY, NLST, LEAP (could also be a short depending which way the break happens)

Also, these might be interesting: THQI, ALSK, IVAN

Monday, February 6, 2012

Watchlist for the week of Feb 6-10

The market is in an uptrend, there's no arguing about it. How long will it last? Who knows... But for now, the best r/r is to the long side. Biotech and shippers are doing very well these days. Here's a few stocks I'm watching for the week, in no particular order:

Long: BIOF, TNK, CCIH, PWAV, TWER, CCJ, EGHT, ROYL, VVTV, DMND, FCX, VMED, MTG, SOL, HSOL, WRES, GTIV, VIT, STAA

Good luck this week!

Long: BIOF, TNK, CCIH, PWAV, TWER, CCJ, EGHT, ROYL, VVTV, DMND, FCX, VMED, MTG, SOL, HSOL, WRES, GTIV, VIT, STAA

Good luck this week!

Sunday, January 29, 2012

Watchlist for the week of Jan 30 to Feb 3

Hey! This is going to be a short post again, I have family in town visiting, so it's been busy! Anyway, here it is:

Long setups: VISN, BIOF, CDTI, XTEX, CPLP, BPAX, AONE, CCIH, ATHN, ANW, KV/A

Short setups: PEIX, SIMO, SPRD, MBI, BGS, FTK, CHTP

Good luck this week!

Long setups: VISN, BIOF, CDTI, XTEX, CPLP, BPAX, AONE, CCIH, ATHN, ANW, KV/A

Short setups: PEIX, SIMO, SPRD, MBI, BGS, FTK, CHTP

Good luck this week!

Monday, January 16, 2012

Watchlist for the week of Jan 16-20

This is going to be a short post, I'm too busy these days... I'm not expecting much in the markets this week, maybed we stay in a range from 127-130.

Long setups for the week: ASIA, DVR, STAA, DEXO, MNI, CLDX, ZOLT, MPG, KKD, VDSI, ELN, REDF, SVNT.

Parabolic shorts: I'm watching a bunch of these bios REGN, IDIX, BVSN, ACHN, SNTS

Good luck!

Long setups for the week: ASIA, DVR, STAA, DEXO, MNI, CLDX, ZOLT, MPG, KKD, VDSI, ELN, REDF, SVNT.

Parabolic shorts: I'm watching a bunch of these bios REGN, IDIX, BVSN, ACHN, SNTS

Good luck!

Sunday, January 8, 2012

The week ahead Jan 8-12

The scenario I posted 2 weeks ago played out very nicely, and now we are forming a tight range in the S&P and DJ. These two indices broke out of the triangle ranges they had been forming in the last 3 months, and now seem to be flagging on the daily. The Russell is still in the triangle consolidation (slightly lagging the other indices) and the Nasdaq has yet to reach the top of the range from 2 months ago.

A small time correction here would be great, so I'm expecting more choppiness in a tight range, and then a move higher from here. Since last week, Europe doesn't sem to matter anymore... The ATR of the indices has been dropping and overall volatility as well. This to me signals a possible beginning of a trend! Or, it could also be the calm before the storm... we'll have to see.

Here's a few stocks I'm watching this week:

Long: OVTI, AAWW, AVID, EGLE, TLB, FWLT, OXY, GNW, MTOR, PWER, CADX, AXTI, ARAY, MY, QTWW, FFN

Short: QCOR, WLT, SINA, CTRP

Possible parabolic shorts: LCAV, REE, ZGNX, BDCO, MON

A small time correction here would be great, so I'm expecting more choppiness in a tight range, and then a move higher from here. Since last week, Europe doesn't sem to matter anymore... The ATR of the indices has been dropping and overall volatility as well. This to me signals a possible beginning of a trend! Or, it could also be the calm before the storm... we'll have to see.

Here's a few stocks I'm watching this week:

Long: OVTI, AAWW, AVID, EGLE, TLB, FWLT, OXY, GNW, MTOR, PWER, CADX, AXTI, ARAY, MY, QTWW, FFN

Short: QCOR, WLT, SINA, CTRP

Possible parabolic shorts: LCAV, REE, ZGNX, BDCO, MON

Subscribe to:

Posts (Atom)